BMW i3 I01 s (94 Ah) - Costs

Monthly costs for BMW i3 I01 s (94 Ah)

Find out the monthly maintenance cost for one BMW i3 I01 s (94 Ah) with tax, running costs, insurance and workshop costs. If you are interested in leasing a BMW i3 I01 s (94 Ah), you may need to consider not only the regular lease payments, but also the other costs incurred. For this offer, for example, transfer costs in the amount of 999 €. With a lease term of 36 months and a monthly lease payment of 375 € with 10000 km mileage per year, there are fixed leasing costs of 14499 €. The insurance costs for the BMW i3 I01 s (94 Ah) are on average high with approx. 73 € per month. On average, the BMW i3 I01 s (94 Ah) trades for 41150 €, the offered vehicle has a gross list price of 46780 €.

BMW i3 I01 s (94 Ah) Total cost & lease factor

Calculation basis

The lease payment is 375 € per month for a term of 36 months, so it is an average-priced offer. Can we still talk about a leasing deal for the BMW i3? The decisive factor is the leasing factor, which is calculated by dividing the leasing rate by the gross list price.

The monthly leasing rate must also be supplemented by ancillary costs, e.g. transfer and registration. However, these costs are kept within limits with this offer at 999 €. Dividing the total costs (leasing costs + fixed costs = 14499 €) by the number of months (for this offer: 36 months) gives the monthly effective costs. If you then divide this amount by the gross list price of 46780 €, you get the leasing factor. With this BMW i3 results in an effective leasing factor of 1.02, the leased vehicle is therefore average value for money, it may be worthwhile to make a further leasing comparison.

Fixed costs

Leasing rates / 36 months

13.500,00 €

Transfer / Approval

999,00 €

Total cost

14.499,00 €

Leasing factor

Total cost

14.499,00 €

Runtime

36 Months

Leasing rate

375,00 €

(315,13 € netto)

Effective leasing rate

402,75 €

(338,45 € netto)

Bruttolistenpreis

46.780,00 €

Leasing factor

0.95

Effective leasing rate

1.02

BMW i3 I01 s (94 Ah) Cost per kilometer

Calculation basis

The costs per kilometer are decisive in kilometer leasing, especially if they have to be borne privately. With a monthly leasing rate of 375 €, the BMW i3 I01 s (94 Ah) is already somewhat expensive anyway. When calculating the costs per kilometer, however, a distinction should still be made between a rather short leasing period (2 - 3 years) and a longer one (4 - 6 years). For simplicity, we ignore this difference in the following calculation example and assume a lease term of 36 months at the most favorable lease price . The cost of operating the vehicle, an electric car, so the cost of electricity, amount to just 85 € monthly, as the vehicle is very economical. In addition, there are insurance costs of 73 € per month, which is quite a low amount but of course mainly due to the low gross list price (46780 €) and the vehicle size. The total invoice for this offer also includes the transfer and registration costs in the amount of 999 € (one-time). The final assessment of this offer: rather high cost per kilometer (0.48 EUR) meets a rather high effective leasing factor of 1.02. You should only accept this offer if you want this car from this dealer.

The previous costs are now summed and divided by the number of inclusive kilometers (10000 km multiplied by the term 36 months).

Fixed operating costs

Costs p.a. (excl. leasing)

9.855,00 €

Actual cost / Km

Fixed operating costs

9.855,00 €

Lease payments Total

13.500,00 €

Total cost

23.355,00 €

Total kilometers

30.000,00

Cost / Km (only leasing)

0,48 €

Cumulative total cost / Km

0,48 €

Price development leasing BMW i3 I01 s (94 Ah)

Cheaper offers of the same vehicle class

Mazda MX-30 e-SKYACTIV INDUSTRIAL VINTAGE

∅ Cost / km

0,30 €

Leasing factor

1.04

from249,00 €

Opel Corsa -e Elegance Elektro/IntelliLux LED/Navi/Sitzheizung/Rückfahrkamera

∅ Cost / km

0,27 €

Leasing factor

0.87

from209,90 €

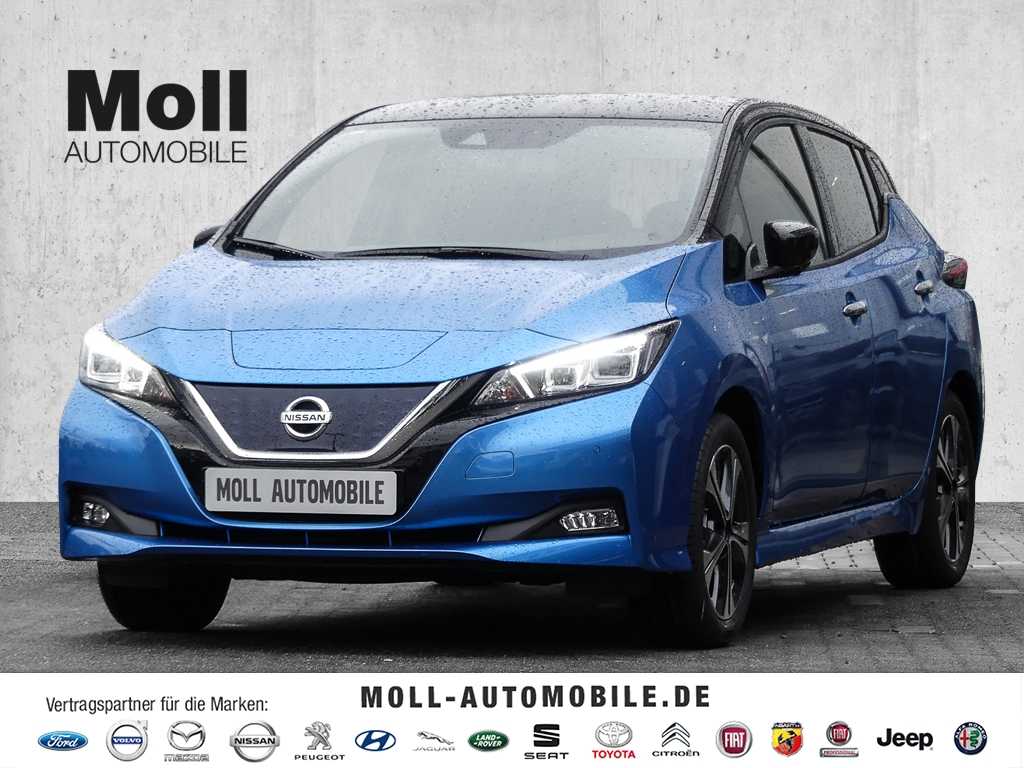

Nissan Leaf ZE1 MY19 - Winterpaket, Navi, 360 Grad Kamera **sofort verfügbar**

∅ Cost / km

0,22 €

Leasing factor

0.51

from149,00 €